All Categories

Featured

Table of Contents

[/image][=video]

[/video]

If you remain in great health and wellness and happy to go through a medical examination, you might get approved for standard life insurance at a much reduced expense. Guaranteed issue life insurance policy is frequently unneeded for those in excellent wellness and can pass a medical examination. Since there's no clinical underwriting, also those in excellent health and wellness pay the very same premiums as those with wellness problems.

Given the lower protection quantities and greater costs, guaranteed problem life insurance policy may not be the very best choice for long-term financial planning. It's often more fit for covering final expenses as opposed to changing revenue or considerable debts. Some guaranteed issue life insurance plans have age limitations, often restricting candidates to a specific age variety, such as 50 to 80.

Nonetheless, guaranteed concern life insurance policy comes with greater premium expenses contrasted to medically underwritten policies, however rates can differ substantially depending on factors like:: Different insurance coverage firms have various pricing models and may use various rates.: Older applicants will pay higher premiums.: Females usually have lower prices than men of the same age.

: The death benefit amount affects premiums. A $25,000 plan costs less than a $50,000 policy.: Paying costs month-to-month costs more overall than quarterly or annual payments.: Whole life premiums are higher general than term life insurance policy plans. While the assured concern does come at a rate, it supplies crucial insurance coverage to those that may not get traditionally underwritten plans.

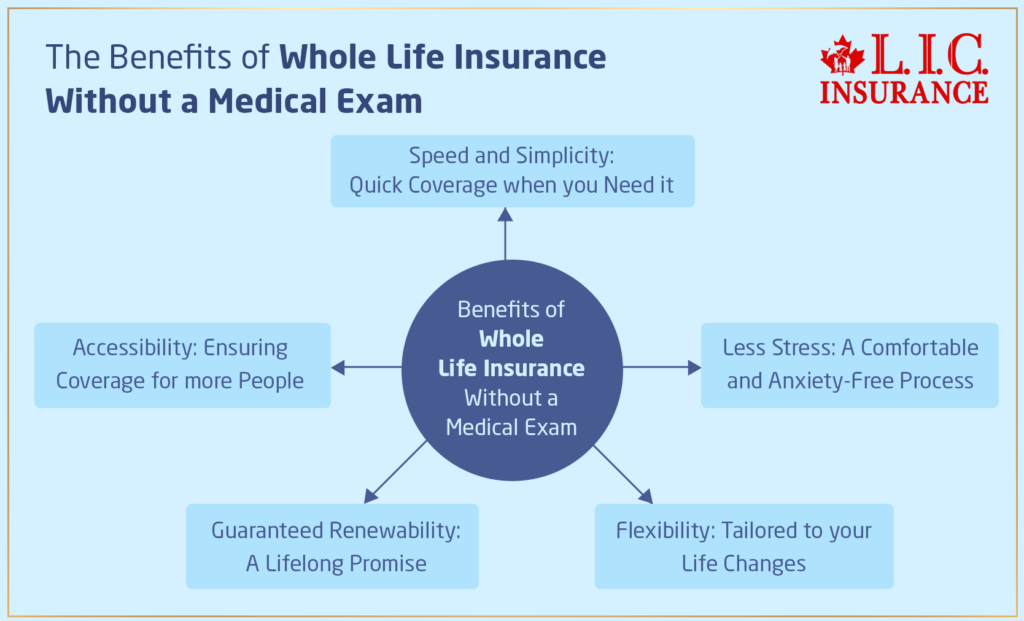

Surefire concern life insurance policy and streamlined issue life insurance coverage are both kinds of life insurance coverage that do not require a medical examination. However, there are some important differences between both kinds of policies. is a type of life insurance policy that does not call for any type of health inquiries to be answered.

The Single Strategy To Use For Get Instant Life Insurance Quotes Online For Fast Coverage!

Guaranteed-issue life insurance policies commonly have higher costs and lower fatality advantages than conventional life insurance policy policies. is a kind of life insurance coverage that does require some health and wellness questions to be addressed. The wellness questions are usually less extensive than those requested for traditional life insurance policy plans. This means that streamlined issue life insurance policy policies may be readily available to individuals with some health and wellness issues.

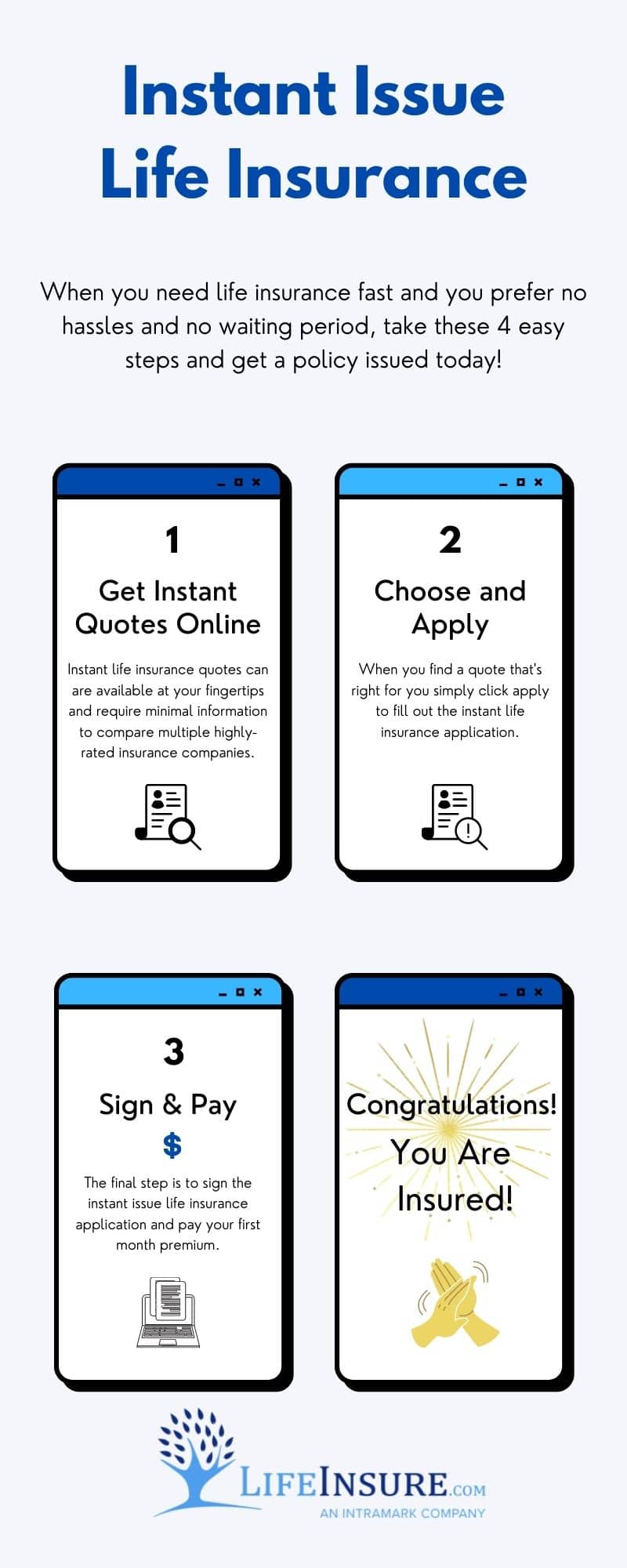

Today, underwriters can examine your info swiftly and come to a coverage decision. In some instances, you could even have the ability to obtain instant protection. Instant life insurance policy coverage is insurance coverage you can obtain an immediate solution on. Your plan will start as quickly as your application is approved, meaning the entire procedure can be carried out in less than half an hour.

Initially, instantaneous protection only relates to call policies with accelerated underwriting. Second, you'll require to be in excellent wellness to qualify. Lots of internet sites are encouraging instant insurance coverage that begins today, yet that does not mean every applicant will certify. Frequently, clients will submit an application thinking it's for instantaneous insurance coverage, just to be fulfilled with a message they require to take a medical examination.

The same details was after that made use of to authorize or deny your application. When you use for an accelerated life insurance coverage plan your data is assessed immediately.

You'll after that get immediate approval, split second denial, or observe you require to take a clinical exam. There are several options for instant life insurance.

Some Known Facts About How To Buy Life Insurance Without A Medical Exam.

The firms listed below deal entirely online, straightforward alternatives. They all offer the opportunity of an instantaneous choice. Ladder plans are backed by Integrity Protection Life. The company supplies versatile, instant policies to people in between 18 and 60. Ladder plans permit you to make adjustments to your coverage over the life of your policy if your requirements alter.

The company uses policies to applications in between 21 and 55 for a ten-year term, and between 21 and 45 for a 20-year term. You'll get an immediate decision from Bestow. There are no medical examinations required for any type of applications. Principles plans are backed by Legal and General America. The business doesn't offer plans to citizens of New York state.

Simply like Ladder, you could need to take a medical examination when you get protection with Ethos. Nonetheless, the business claims that the majority of candidates can get insurance coverage without an exam. Unlike Ladder, your Values policy will not start right away if you require a test. You'll need to wait until your exam outcomes are back to get a price and buy coverage.

In various other situations, you'll require to supply even more info or take a medical exam. Right here is a rate contrast of insant life insurance coverage for a 50 year old male in good health and wellness.

Lots of people start the life insurance policy purchasing plan by getting a quote. You can get quotes by entering some fundamental details online like your age, sex, and basic health condition. You can after that pick a business and adjust your strategy. Allow's claim you got a quote for $50 a month for a $500,000, 20-year plan.

You can establish the specific coverage you're using for and after that begin your application. A life insurance application will ask you for a lot of details.

Aig Direct Life Insurance for Dummies

It's essential to be 100% sincere on your application. If the company finds you didn't divulge details, your policy could be denied. The decline can be reflected in your insurance coverage rating, making it more difficult to get coverage in the future. As soon as you submit your application, the underwriting formula will certainly examine your info and pull information ahead to an immediate decision.

A streamlined underwriting plan will certainly ask you in-depth questions regarding your clinical background and recent clinical treatment throughout your application. An immediate issue policy will certainly do the exact same, but with the distinction in underwriting you can get an instantaneous decision. There are numerous distinctions in between surefire concern and immediate life insurance policy.

Plus, guaranteed problem policies aren't able to be used throughout the waiting duration. For most plans, the waiting period is 2 years.

If you're in good wellness and can certify, an immediate issue policy will allow you to obtain protection with no test and no waiting period. In that case, a streamlined issue plan with no exam might be best for you.

8 Easy Facts About What Is Instant Life Insurance? Shown

Streamlined problem policies will take a few days, while immediate policies are, as the name indicates, immediate. Purchasing an instant policy can be a fast and simple process, yet there are a few things you need to keep an eye out for. Before you hit that purchase button see to it that: You're buying a term life plan and not an unintended death policy.

They don't offer coverage for disease. Some firms will certainly provide you an unexpected fatality plan promptly but require you to take a test for a term life policy. You have actually checked out the fine print. Some internet sites are full of colorful images and strong pledges. Make certain you review all the details.

Your representative has actually answered all your concerns. Similar to internet sites, some representatives stress they can obtain you covered today without explaining or supplying you the details you need.

Latest Posts

5 Best No-exam Life Insurance Companies Of 2024 Can Be Fun For Everyone

Rumored Buzz on Term Life Insurance – Get A Quote

Guaranteed Life Insurance Can Be Fun For Everyone